Nintendo just released notes from their Third Quarter Financial Results Briefing. Overall, the report showed a good year for the cornerstone game company. Satoru Iwata, president of Nintendo, led the meeting and started by explaining where the company will concentrate their efforts in the coming year. Nintendo intends to take advantage of small devices, more aggressive use of their character IP, and a new QOL improvement platform business. At this time he could not comment more and shifted focus to evaluating the sale numbers for the year. This is the first year that Nintendo has managed to balance their costs and return to operating profits.

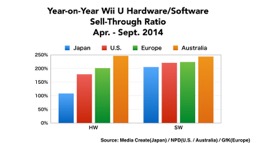

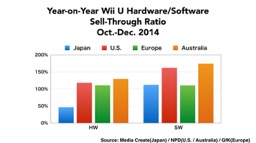

For reader understanding, the year-by-year sale comparison charts compare the previous year with the latest year, showing the percentage of change between the two.

Iwata began his presentation with the state of 3DS sales, including hardware and software of the New Nintendo 3DS. Total sales of the Nintendo 3DS family hardware have reached 50.41 million units, crossing the 50-million-unit mark.

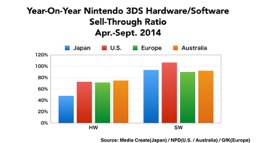

April and September demonstrated a slower period for hardware in Japan, but fairly good numbers for overseas markets; while software sales remained steady. Iwata attributes these numbers to Yokai Watch2 Honke and Yokai Watch2 Ganso July releases in Japan, Super Smash Bros. for Nintendo 3DS September Japanese release, as well as steady sales of Pokémon X and Y overseas.

During the third quarter the Japanese market received a bump in hardware and software sales due to the release of the New Nintendo 3DS; however, the Australian release of the New 3DS did not increase hardware sales there. Nintendo contributes the lack of Australian hardware sales to the late release in the quarter. They also cite the North American February release date as the reason for lack of software sales in that region. Iwata stated in regards to the dip in software sales,

“It is said that the basic principle in the video game industry is good game titles boost hardware sales. In this case, however, New Nintendo 3DS, which has been highly acclaimed by consumers in the markets where it is available, worked to shift consumer demand for the year-end sales season to the next year or to steer it toward other products.”

In the Japanese market Nintendo released five double million titles from July to December. Nintendo expects Super Smash Bros. 3DS to continue to sell well as the European market becomes more familiar with it. They also expect Pokémon Alpha Sapphire and Pokémon Omega Ruby to continue selling well despite skepticism of it being remakes of previous titles.

An interesting part of this presentation is Nintendo’s attention to the similar sales’ progression of Animal Crossing: New Leaf and Tomodachi Life. Their interest lies in the success of the relatively unknown IP Tomodachi, especially with female gamers. Nintendo believes it can expand the reception of the 3DS with titles like these as they experience less competition and appeal more to female gamers.

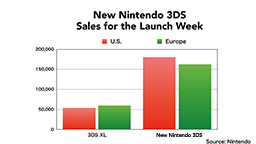

Iwata notes the early success of the New Nintendo 3DS launch in America. Special-edition hardware created for the release were virtually sold out before the official launch of the new handheld console. A side by side comparison of the 3DS XL and the New 3DS shows the marked increase of hardware sales for the latter. Nintendo feels very confident in the list of first and third-person titles scheduled to come out this year.

Iwata notes the early success of the New Nintendo 3DS launch in America. Special-edition hardware created for the release were virtually sold out before the official launch of the new handheld console. A side by side comparison of the 3DS XL and the New 3DS shows the marked increase of hardware sales for the latter. Nintendo feels very confident in the list of first and third-person titles scheduled to come out this year.

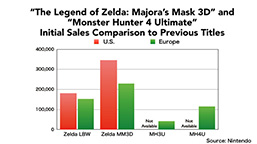

An early comparison of the sales numbers of Majora’s Mask and Monster Hunter 4 Ultimate, the two New 3DS launch titles, demonstrate an increase in sales from the previous series’ titles to the current titles. While final numbers are unavailable, it seems that sales have been very strong.

Nintendo is also committed to expanding multiplayer Local Play to accelerate expansion in overseas markets. The motivation stems from wanting to increase enjoyment of gaming on the 3DS to increase word-of-mouth as well as demonstrate the stability of this new platform.

Iwata shifted attention to the Wii U. Wii U hardware sales jump in the Australian market during the first quarter of the year. Iwata credits the release of Mario Kart 8 in May combined with Australia’s unique June/July winter sales. Japan’s Wii U sales dropped by nearly fifty percent during the third quarter of last year. Nintendo’s analysis of the dip in Japanese sales concludes the New 3DS received more attention than the Wii U and many big titles were released for the New 3DS, decreasing the priority of the Wii U console.

Iwata shifted attention to the Wii U. Wii U hardware sales jump in the Australian market during the first quarter of the year. Iwata credits the release of Mario Kart 8 in May combined with Australia’s unique June/July winter sales. Japan’s Wii U sales dropped by nearly fifty percent during the third quarter of last year. Nintendo’s analysis of the dip in Japanese sales concludes the New 3DS received more attention than the Wii U and many big titles were released for the New 3DS, decreasing the priority of the Wii U console.

Iwata also wanted to reiterated their focus on enriching the value of the Wii U gamepad. They plan to release games that fully utilize the potential of the gamepad as well as UGC, user generated content.

Iwata also wanted to reiterated their focus on enriching the value of the Wii U gamepad. They plan to release games that fully utilize the potential of the gamepad as well as UGC, user generated content.

Iwata understands there are still unclear obstacles they must contend with in regards to Wii U hardware sales in Japan and 3DS sales in the US and Europe; however, sales of Nintendo titles remained strong and received high evaluations. Last year 19 Nintendo titles received a 85 or higher Metascore and a User Score of 8.5 or higher. While not the final testament to the quality of a game, it reflects well on Nintendo.

Amiibos have been a pleasant surprise for Nintendo, shipping 5.7 million figures and selling out some of the figures. Iwata describes the amiibos as “game connectable figures” that work across multiple titles. Nintendo wants to expand the titles that work with the amiibos, a notable title being Mario Party 10. The amiibo price is affordable for consumers, dropping a smaller percentage drop after year end sales than packaged titles. Iwata sees the potential for maintaining active use of Nintendo platforms by releasing addition content with new releases. The US and Canada had the highest percentage of region sales, coming in at 63% of total shipment.

In addition to the figures, Nintendo is planning to launch amiibo cards with more details to come. With your purchase of an amiibo comes access to highlighted game sequences from NES and SNES games. Just a tap of the figure on the NFC area will initiate a new highlighted sequence. Nintendo will continue to focus time and effort on amiibos and 3DS compatibility.

Nintendo expanded its digital sales numbers in 2014. While there was tapering during the previous year, the recent numbers show a 17% increase. Japan’s market slowed slightly, but the US market increased as well as the European market. The US market shows the most promise for increasing digital sales as seen in this graph.

Nintendo looks primed to be a major force in gaming again. This Financial briefing certainly clarifies the direction the company is headed. The numbers show an increased interest in Nintendo hardware and software, with some variation across regions. The expansion into Europe is helping boost their brand and allow them to explore a larger audience. Nintendo is rebounding and will bring some interesting new concepts to gaming this year.

BrutalGamer Bringing you Brutally Honest feedback from today's entertainment industry.

BrutalGamer Bringing you Brutally Honest feedback from today's entertainment industry.